Recent Posts

Home >Unlabelled > S&P 500 Stocks Swing Up And Down In Unison, Creating Huge Movements In SPY on Astini News

S&P 500 Stocks Swing Up And Down In Unison, Creating Huge Movements In SPY on Astini News

Posted on Tuesday, September 6, 2011 by astini

Exchange-traded funds and the broader stock markets have been moving as a pack during the volatile "risk-on" and "risk-off" trades and wide swings in market sentiment.

According to Bespoke Investment Group, the S&P 500 is experiencing a high frequency of "all-or-nothing" days. In other words, stocks have been moving in unison — they tend to moving higher or lower as a group.

Over the last 20 trading days, 12 all-or-nothing days have been recorded, according to Bespoke. Data since 1990 reveals that during one other period, in 2008, did we see the same levels of extreme advancing or declining days.

Year-to-date, 32 all-or-nothing days on the S&P 500 have been recorded.

From ETF Trends' "Are ETFs Responsible for Rising Market Correlations?":

While the volatility of the credit crisis has certainly contributed to the uptick in 'all or nothing' days over the last few years, an even larger contributor has been the ETF industry," according to Bespoke. "It is not a coincidence that the increase in 'all or nothing' days has risen right in tandem with the explosion in volume of ETFs like SPY.

And from ETF Trends' "Sector ETF Correlations at Two-Year High: Strategist":

Correlations in equities have risen lately. High correlations are not indicative of a healthy or normal market, analysts say. A higher correlation means prices are moving together, rather than going their separate ways.

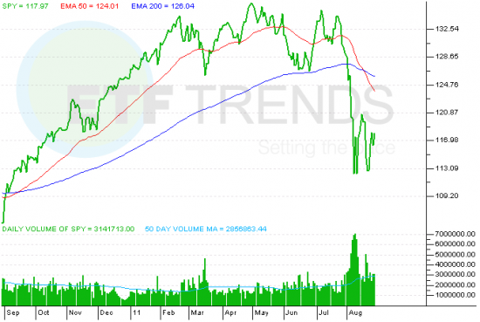

SPDR S&P 500 ETF (SPY)

For more information on the stock market, visit our S&P 500 category.

Max Chen contributed to this article.

Disclosure: My clients own SPY.

Blog Archive

-

▼

2011

(2934)

-

▼

September

(682)

- This family’s favourite kitchen tool is a comput...

- News - The Neshoba Democrat on Astini News

- News: Mozambique proposes law to axe VAT on animal...

- Try Thanksgiving in Belize, Says The Lodge at Chaa...

- The Origin Of The Word 'Epilepsy' : NPR on Astini ...

- Arizona to host GOP presidential debate in Decembe...

- Schizophrenia - Pipeline Review, H2 2011 on Astini...

- Nicolas Cage on 'The Expendables 2' and 'Ghost Rid...

- Who deserves 2011 PGA Tour Player of the Year hono...

- Lille midfielder Joe Cole targets England recall o...

- What is Sonic the Hedgehog Without a Sega Console?...

- Salespeople at three Bob's Discount Furniture stor...

- on Astini News

- Stocks ending gloomy 3rd quarter on a weak note - ...

- BLABBERMOUTH.NET on Astini News

- Does it work? Can maca increase sexual appetite? -...

- Giants trying to avoid 'trap' vs. Cardinals on Ast...

- Sharpshooting Fairfield detective places 11th on H...

- Obama's race problem is black and white -- and gre...

- Premier League football news from the Barclays Pre...

- HBO Marketing Chief Courteney Monroe to Step Down ...

- 750 pieces of John Wayne's life on the block - Loc...

- Present-Day Republican Rage Pre-Dates the Tea Part...

- Frances Bean Cobain | Frances Bean Cobain Turns To...

- OS X Lion / Snow Leopard Now Required to play 'Cit...

- Nassau County detective quitting over allegation s...

- Daniel Radcliffe A 'Star Wars' Virgin - Entertainm...

- Google Fights German Lawsuit Over ‘Sex-Club Bill...

- New ACDSee Photo Editing and Management Products D...

- ROM – @nickmcminn60 MIUI SS-8 “LG 2X Editionâ€...

- George Clooney Defends Ex Elisabetta Canalis From ...

- IRONCLAD (2011) on Astini News

- Actors Who Should Win And Who Will Win (PHOTOS) on...

- Young Canadians are creating a better world on Ast...

- Nine Named Semifinalists For 2012 Kentucky Teacher...

- Be Trafalgar’s guest by watching Better Homes & ...

- Grocery stores expanding generic brands on Astini ...

- Summer over, Cape road work abounds on Astini News

- Charles Manson and Me: A Memoir on Astini News

- Your Kid’s Brain, SpongeBob-ed | NewAmerica.net ...

- Extreme Weather Leads To Spike In Sales on Astini ...

- Australia ruling in Apple vs Samsung case expected...

- Titan Medical Inc. Announces Memorandum of Underst...

- DAILY YOMIURI ONLINE (The Daily Yomiuri) on Astini...

- A gluten-free for all drives product sales | Reute...

- Space Shuttle Enterprise Unveiled 35 Years Ago to ...

- Prime Limousine, Audi sign deal on 100 Audis for E...

- South Africa ponders issuing visa for Dalai Lama o...

- 'We the People' captures American spirit | MyCentr...

- on Astini News

- Neil Young’s book deal sparks hunt for Canadian ...

- The Sweet Smell of Easier Weight Loss? on Astini News

- Living | Angry Birds game may top holiday toy sale...

- SEC probes RBS,Credit Suisse over bad mortgage loa...

- Top 100 ALA Banned Books: Harry Potter | The Back ...

- I-Team 10 investigation: Pizzeria employee accused...

- US scientists testing earthquake early warning - T...

- Holy Land 9/3/11 - Celebrity Review by tigershark1...

- J. Cole on His Album’s Eleventh-Hour Jay-Z Verse...

- Bowling for a Cause - Yahoo! Finance on Astini News

- Car Charging Group to Provide EV Charging Services...

- PR-USA.net on Astini News

- Arkham City Xbox 360 Bundle Shows Up on German Ama...

- Braylon Edwards has knee procedure, out a while - ...

- Tea Party Group to Form Super PAC on Astini News

- New Jersey Mining Company Intersects 5.07 g/t Gold...

- 'Your Highness' is supposed to be stupid; it succe...

- Analyzing The Price-To-Cash-Flow Ratio - Yahoo! Fi...

- : Movies :: News :: Paste on Astini News

- ASIC to review broker capital rules: report | News...

- Portuguese Man o' War threat underestimated by swi...

- UK professor 'reconstructs' lost Beethoven piece |...

- Award-winning producer Jon Blair joins Aljazeera o...

- Diablo 3 Community Site Offers Peak at Game's Trea...

- Valencia vs. Chelsea: Champions League Match Will ...

- Tinker, Tailor, Soldier, Spy would have been so mu...

- Anna Faris answers film question "What's Your Numb...

- Guild Wars 2 Closed Beta Still Coming This Year --...

- Listen To The Weeknd Remix Of Florence + The Machi...

- Blackberry Mom: Shel Silverstein truly inspiring o...

- Deal watch: Norwegian Cruise Line launches another...

- AQM Announces the Discovery of the New Victoria Po...

- Ludacris, Bay City Rollers hit town in November on...

- Kim Kardashian leaves wedding ring home - Entertai...

- Voting important for youth - EEC on Astini News

- Buy Dish TV; target price raised, stock is getting...

- Weather Underground Launches Its New Weather API P...

- A victory for common sense on Astini News

- The top Typing Games Every Kid Have to Have! – E...

- Game: "Martians Vs. Goblins" F. Tyler The Creator ...

- Column: With Bielema playing ‘respect’ card, N...

- East Valley Tribune - Arizona Local News on Astini...

- Pan-Seared Chicken with Chicory, Bacon & Figs on A...

- Tax filing relief to those hurt by Hurricane Irene...

- DTS and Huawei Showcase Superior Audio Technologie...

- 'Paradise Lost' director Joe Berlinger sought just...

- Samsung Mobile Announces New Expansion of Galaxy F...

- 'Revolutionary,' Controversial Idea : NPR on Astin...

- J. Cole Is a Storyteller in 'Daddy's Little Girl' ...

- IIS 7.0 Detailed Error - 503.4 on Astini News

-

▼

September

(682)